Budget vs Net Worth Tracking

The Secret to Building Wealth?

The Secret to Building Wealth? Track Your Net Worth, Not Just Your Budget

Most people dream of growing their wealth but miss an important step - actively tracking their money. While budgeting is important, monitoring your net worth gives you the complete picture of your financial health.

I want to share my journey from spreadsheet tracking to automating the process and help you choose the right tools for your financial goals.

The Basics

Yes, you can track everything in Excel (I did this for years). It works, but manually updating multiple account statements becomes a part-time job. As your wealth grows, this becomes increasingly complex and time-consuming. That's why I moved to automated apps.

Budgeting vs. Net Worth

I've learned that your needs evolve as your wealth grows. When starting out, budgeting is critical - tracking every dollar helps you build good habits. But as you accumulate assets across multiple accounts (retirement, investments, real estate), you need a broader view. That's where net worth tracking becomes essential.

Unfortunately, moving from one app to another has a switching cost. You lose your history and have to learn a new system. That is why I recommend starting early with an app you will grow into, start with net worth tracking early.

What to Look for in a Net Worth Tracking App

Account Integration: Can it connect to all your financial institutions securely?

Asset Categories: Does it handle various asset types (stocks, crypto, real estate)?

Expense Categories: Does it allow you to input your own categories?

Reporting Depth: Can you create annual reports for personal or tax purposes?

User Experience: Is it intuitive enough to use regularly?

Security: How is your data protected?

Cost: how much is the subscription?

Top Apps for Net Worth Tracking:

Empower (formerly Personal Capital):

Best for investment tracking

Free net worth tracking with paid wealth management services

Robust investment analysis tools

Modern interface

Strong budgeting features

Excellent transaction categorization

Privacy-focused (no data selling)

Customizable categories and goals

Strong financial planning tools

Clean, intuitive interface

Integrated investing and tracking

Goal-based planning features

Good for beginners

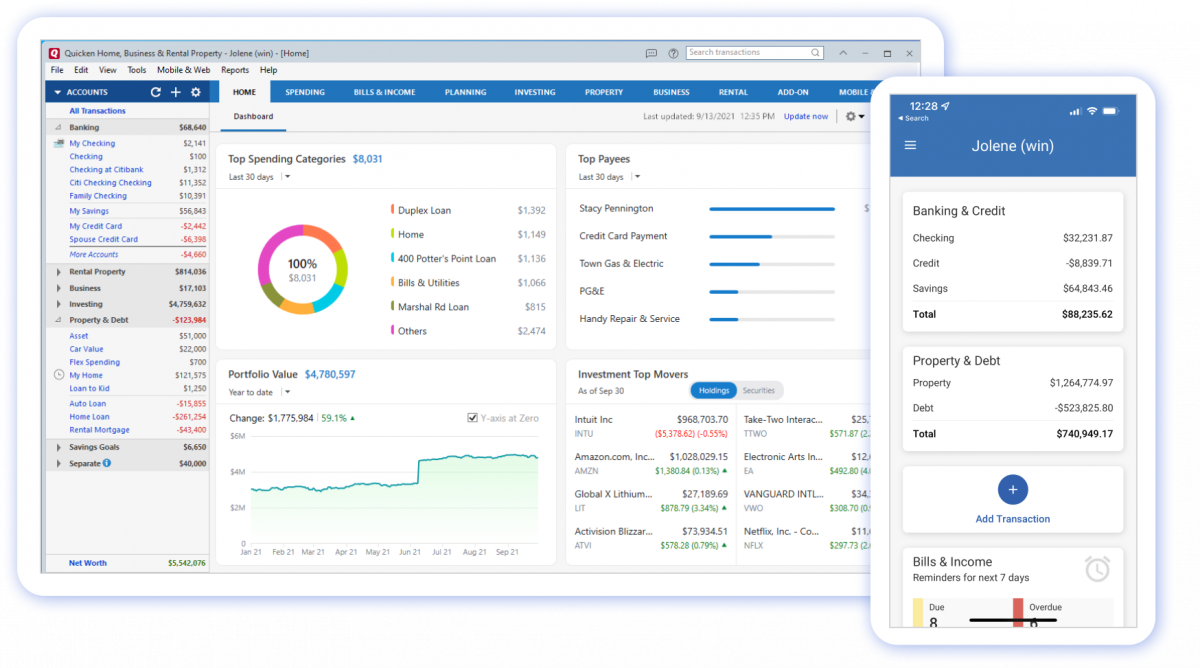

Simplify or Classic by Quicken:

Detailed spending insights

Strong budgeting tools

Legacy of financial software expertise

Reporting (Classic only)

A Word on "Free" Apps: Remember, financial apps need a sustainable business model. If an app is free, understand how it makes money—often by selling aggregated data or offering premium services. Choose based on your privacy preferences and needs.

The best app is the one you'll use consistently. Start with your primary goal (budgeting or tracking your net worth) and choose accordingly. Your future self will thank you for starting this habit today.

Disclaimer: I use Quicken Classic because of its desktop interface, the flexibility of category types, and the budgeting and reporting options. You can use this affiliate link to quicken.sjv.io/gOAeRg

Did you find this helpful? What other questions do you have?