Does Financial Education Improve Financial Literacy?

Research-Based Impact

My colleagues, Dr. Jennifer Davidson and Dr. Jamie Wagner, recently published research demonstrating the power of accessible, well-structured financial education. Their work inspires the programming we designed at Haile College of Business with the Kentucky Financial Empowerment Commission, so I want to share it with you.

Their study, published in the Journal of Financial Counseling and Planning, examined a six-week financial wellness program for public employees in Nebraska. What strikes me most about their findings isn't just the numbers—though an 11% increase in financial knowledge is impressive—but how their research validates what many of us in the field have long believed: quality financial education can transform lives when delivered effectively.

Three Key Insights from Their Work That Inspire Our Approach in Kentucky:

Accessibility Matters

Their webinar-based program drew an impressive 2,000 registrations, with an average of 750 attendees per session. This reminds me why we're committed to meeting Kentuckians where they are, whether online or in their communities.Quality Drives Results

The program's comprehensive curriculum – covering everything from budgeting to estate planning – resulted in nearly 100% of participants reporting increased financial knowledge. This reinforces our commitment to delivering high-caliber, evidence-based training through our initiatives.Impact Reaches Those Who Need It Most

Perhaps most encouraging was their finding that participants with lower incomes showed the greatest improvement. This finding particularly energizes our work at the Commission, where we strive to reach all Kentuckians, especially those facing the most significant financial challenges.

Davidson and Wagner's work isn't just academic research—it's a roadmap showing that our efforts to provide quality financial education can have a real, measurable impact on people's lives. Their research also highlights the importance of program evaluation.

How to Support Financial Literacy Education

Join us to improve your financial well-being:

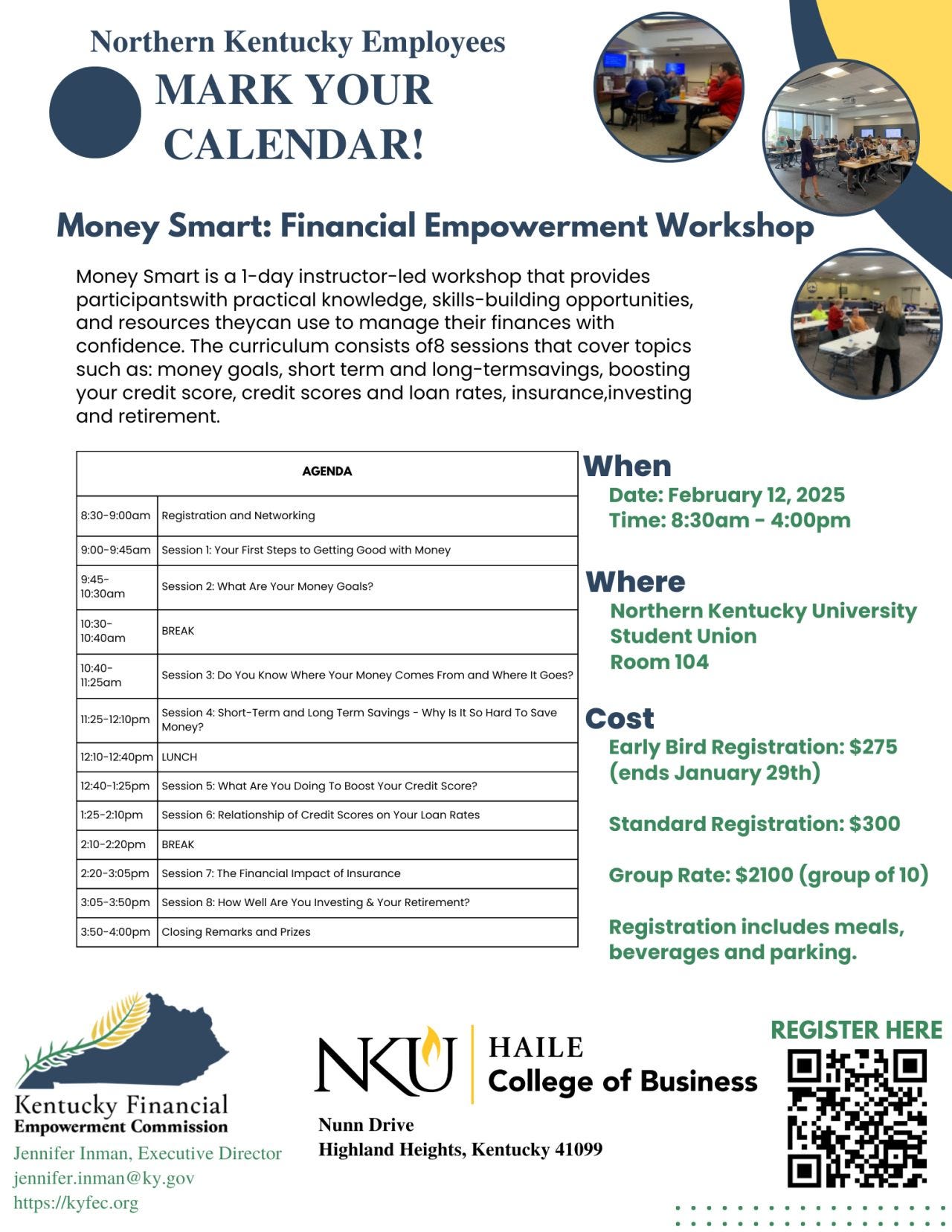

February 12th: Money Smart program with the KFEC

Learn more: https://www.nku.edu/academics/cob/Outreach-and-Engagement/moneysmart.htmlFebruary 25th: Marriage and Money with KFEC and Brian Page from Modern Husbands

Learn more: https://www.nku.edu/academics/cob/Outreach-and-Engagement/Marriage-and-money.html