Housing Collapse?

What we can learn from your search behavior

The housing market is starting to show signs that it is slowing down. We knew that the double-digit growth rates in prices over the past couple of years was not sustainable in the long run, but it seemed like it was hard to stop the housing momentum. The Federal Reserve’s interest rate hikes to combat inflation might spell relief for new home buyers, and fear for current homeowners.

Here is what we know.

The cost of owning a home has increased as interest rates spike. Mortgage rates today are 5.81% on a 30 year mortgage (Forbes). That is up from 5.55% last week. On August 21st 2021, the average 30 mortgage rate was 3.251%. The increase in interest rates impacts home affordability directly.

There are two ways to look at this. First, how much does the payment change for a given loan. For a $300,000 loan with a 30 year fixed rate mortgage at 3.251%, the payment is $1,305. When interest rates increase to 5.81%, that payment jumps to $1,762.

Another way of looking at it, is to ask how much does the loan amount have to decrease by to maintain the same payment? A buyer paying $1,305 per month in principle and interest could afford a $222,000 loan when interest rates increase to 5.81%. The increase in interest rates has chipped away $78,000 in purchasing power.

New home sales are down 17.4% and existing home sales are down 20.2% on a year-over-year basis. Another indication of a slowing market.

Housing inventory is growing. According to Realtor.com, active listings are increasing and days on market are starting to increase.

Data from Google tells us that you are worried about selling your home. Google searches for ‘sell my home fast’ spiked 2,750% three weeks ago. This indicates that more people are trying to sell their homes before the Feds introduce future rate hikes.

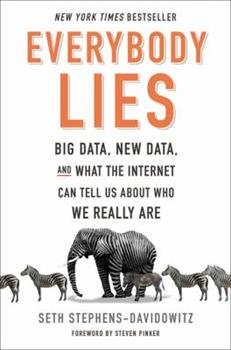

A side note: it turns out that we share our biggest fears ,and secrets, with Google. Interested in learning more about how we tell Google what we think? Check out Everybody Lies: Big Data , New Data, and What the Internet Can Tell Us About Who We Really Are.

Lenders are starting to go out of business. According to Bloomberg, the wave of failures in the mortgage market will be the highest since the 2008 financial crisis.

How is the housing market in your area? I want to hear more about your experience. Drop a comment and tell us what you have seen around you.

Seth Stephens-Davidowitz's Everybody Lies is a great read along with his recently published book Don't Trust Your Gut.