How to Budget Your First Paycheck?

Planing for your first paycheck

Today, we discuss how to plan for your first paycheck using my personal approach to budgeting. In last week’s newsletter we discussed how to calculate your first paycheck. Here is the recap:

Gross Salary: $60,000

Total Deductions: $22,495

Take-Home Pay: $37,105

The take-home pay, what's left after all these deductions, amounts to approximately $37,105.

Budgeting

Now, let's talk about budgeting. The 50-30-20 rule is a simple guideline that helps you allocate your monthly take-home pay efficiently. It suggests that you allocate your income as follows:

50% for Needs: Covering essential expenses like housing, utilities, groceries, transportation, and minimum debt payments.

30% for Wants: Allowing for discretionary spending on non-essential items like entertainment, dining out, and hobbies.

20% for Savings and Debt Repayment: Contributing to your financial goals, such as savings, paying off debt, and contributing beyond your 401(k).

The Numbers

Let's apply the 50-30-20 rule to our example. With a monthly take-home pay of $3,092.08 ($37,105 annually divided by 12), we can break it down like this:

$1,546.04 (50%)

covering rent or mortgage, utilities, groceries, transportation costs, and essential bills. According to apartments.com the average 2 bedroom rent cost is $1,265 in Cincinnati. That is $632 per person.

$927.62 (30%)

for discretionary spending, which can be used for entertainment, dining out, and other non-essential expenses.

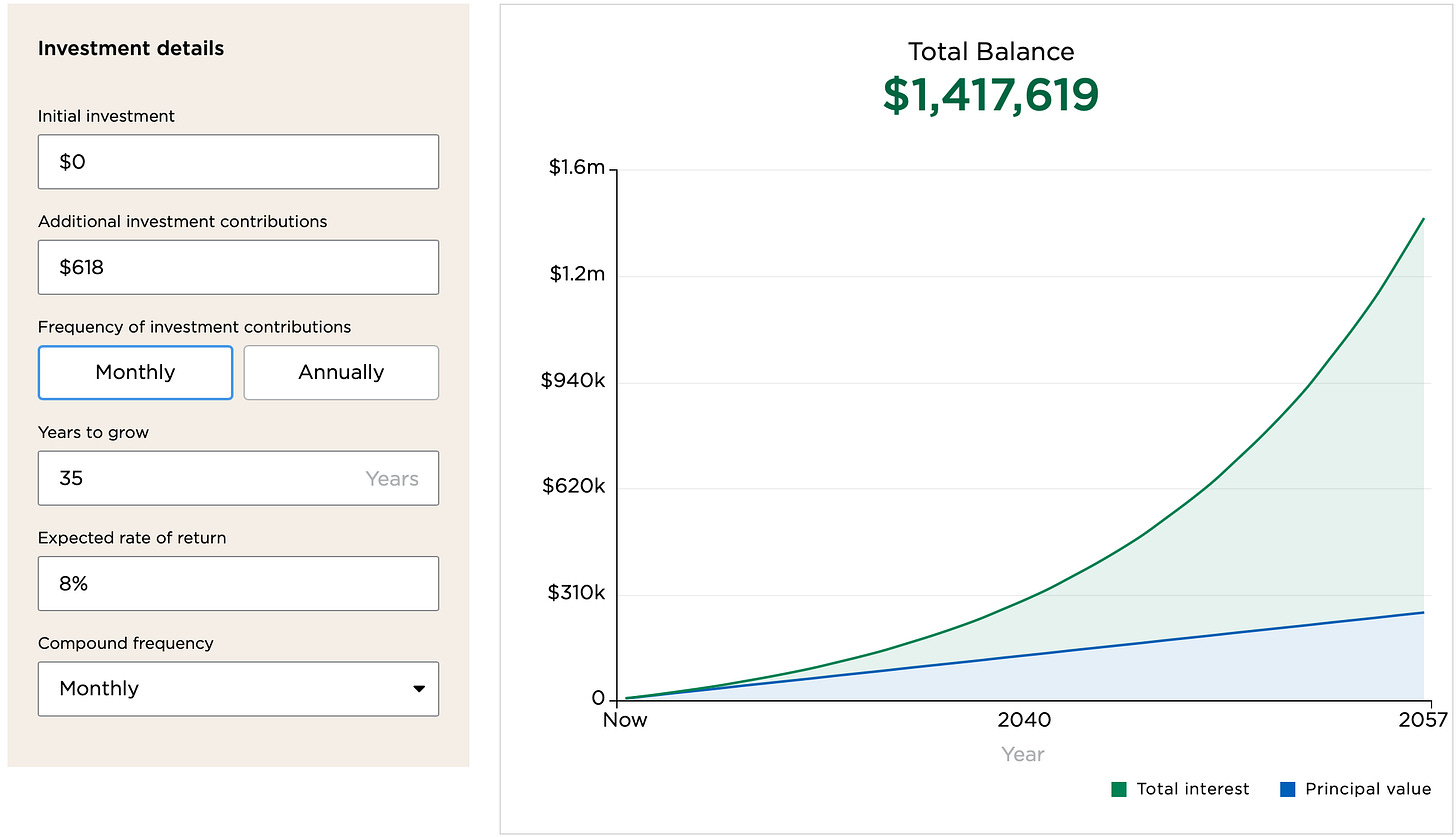

$618.42 (20%)

Remember we have aleardy invested 6% of your pretax salary in your 401k. So this is either additional savings, investments, or debt repayments. Build your emergency fund first, then plan on investing the rest. If you have debt payments that exceed $618 per month, make sure to pull that additional money from your “wants” bucket. If you do not have any debt, then you are off to a great start and can get started on saving and investing. After 35 years, $618 saved monthly at 8% annual return will grow to $1,417,619.

In last week’s newsletter, I shared with you that your 401(k) would grow to $1,326,591. With your additional personal investment of $1,417,619, you would have a total of $2,744,210 saved at retirement.

A big assumption made here is that your income won’t grow over 35 years. As your income grows, the amount of savings will grow just as your amount allocated to wants and needs will.

Takeaway

Knowing how to breakdown your paycheck and making a plan for your dollars will help you build a strong financial foundation.

Thank you for reading and being a part of our community of curious minds. Remember, budgeting and managing your finances is a skill that will serve you well throughout your life. If you have any questions or would like to see more content like this, please feel free to reach out to us. Stay financially savvy, and watch out for our next newsletter!

Question for you

How difficult is it to follow this approach? If you already have a job, are you able to follow this budgeting approach?