Let's Talk Money - Even When It's Hard

Teaching economics and personal finance taught me one thing: these subjects make people feel uncomfortable. Economics throws graphs at you, while money talk? Well, we have made that conversation taboo.

Add a relationship to the mix, and things will get even trickier. Most of us never learned how to talk about money, let alone merge our finances with a partner.

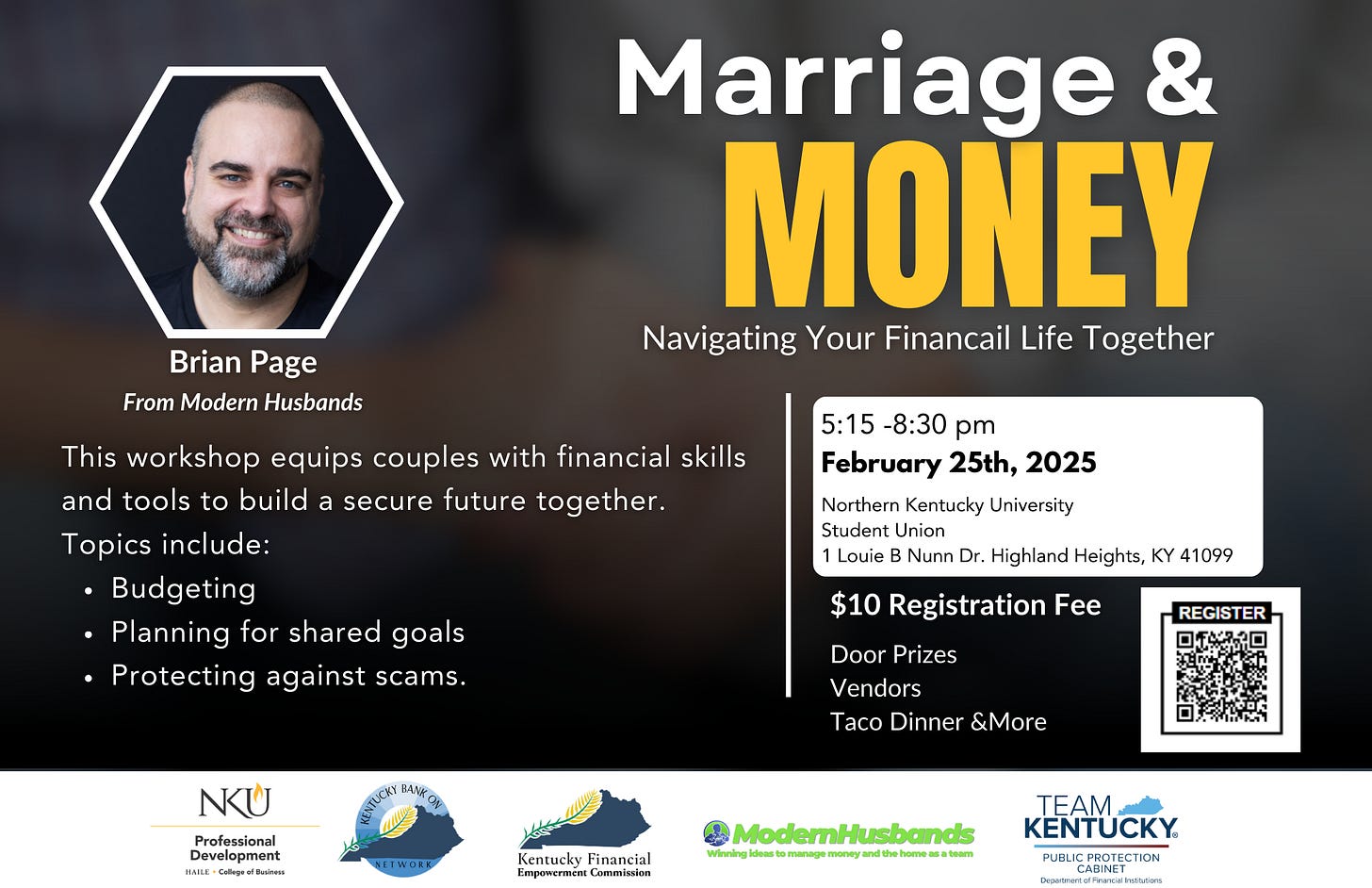

I'm all about making these money conversations normal. Check out Brian Page fromModern Husbands and Ramit Sethi for advice on couple's finances.

Here's what I've learned about money talks between couples:

Four Big Money Conversations You Need to Have:

Your Money Baggage: Those childhood money memories and past financial rough patches? They shape how you handle cash today. I've watched couples have breakthrough moments just by understanding where their partner's money habits come from.

The "What If" Talk: Nobody loves planning for job loss or worse, but having a game plan helps you both sleep better. Talk about insurance, backup plans, and how you'd handle career curveballs.

Family Money Boundaries: Supporting parents or adult kids is tricky territory. Get clear on these commitments together before they cause tension. Your family duties shouldn't derail your shared goals.

Your Financial Freedom: Marriage doesn't mean losing your financial identity. Set an amount you can each spend judgment-free. This will build trust while allowing you to maintain some independence.

Join our "Marriage and Money" workshop with Brian Page on February 25th. Working with the Kentucky Financial Empowerment Commission and NKU Haile College of Business has shown me that these tough money talks are exactly the ones worth having.

Tell me: What's your toughest money conversation with your partner? How'd you handle it?