Misconceptions About the Economy

Economists have work to do!

Inaccurate economic information can have severe consequences for individuals and the broader economy. When people are exposed to misleading or false narratives about the state of the economy, it can significantly alter their behavior and decision-making processes. For instance, if a substantial number of people become convinced that a recession is imminent, they may instinctively reduce their spending and investment activities as a precautionary measure. This shift in consumer behavior can lead to a decrease in demand for goods and services, which, in turn, can slow down economic growth and potentially trigger the recession people feared.

This phenomenon is known as a self-fulfilling prophecy, where a belief or expectation, even if initially false, can influence people's actions so that it ultimately becomes true. In the context of the economy, the widespread belief in an impending recession can create a vicious cycle, causing businesses to scale back investments, leading to job losses and further erosion of consumer confidence.

To prevent such scenarios and protect the stability of our economy, we must prioritize the dissemination of accurate, well-researched, and unbiased economic commentary. By providing the public with reliable information and analysis, we can help individuals and businesses make informed decisions based on the actual state of the economy rather than on speculation or fear.

Today, we are investigating the recent Harris poll conducted exclusively for the Guardian, which indicates widespread misconceptions about the U.S. economy. It’s crucial to separate fact from fiction and understand the fundamental economic landscape, so here is our summary:

Recession Reality Check

Nearly three in five Americans mistakenly believe the U.S. is in a recession, and 55% think the economy is shrinking. Despite these beliefs, the gross domestic product (GDP) has been steadily growing, barring a brief contraction in 2022 that the National Bureau of Economic Research did not classify as a recession.

We are not in a recession.

Stock Market Myths

Almost half of the respondents, 49%, incorrectly believe the S&P 500 is down for the year. The S&P 500 index rose about 24% in 2023 and has increased by more than 12% this year, demonstrating strong market performance.

The stock market is growing.

Unemployment Misunderstandings

Another 49% of those polled think unemployment is at a 50-year high. Contrarily, the unemployment rate has been under 4%, near a historic low, reflecting a robust job market.

The unemployment rate is low.

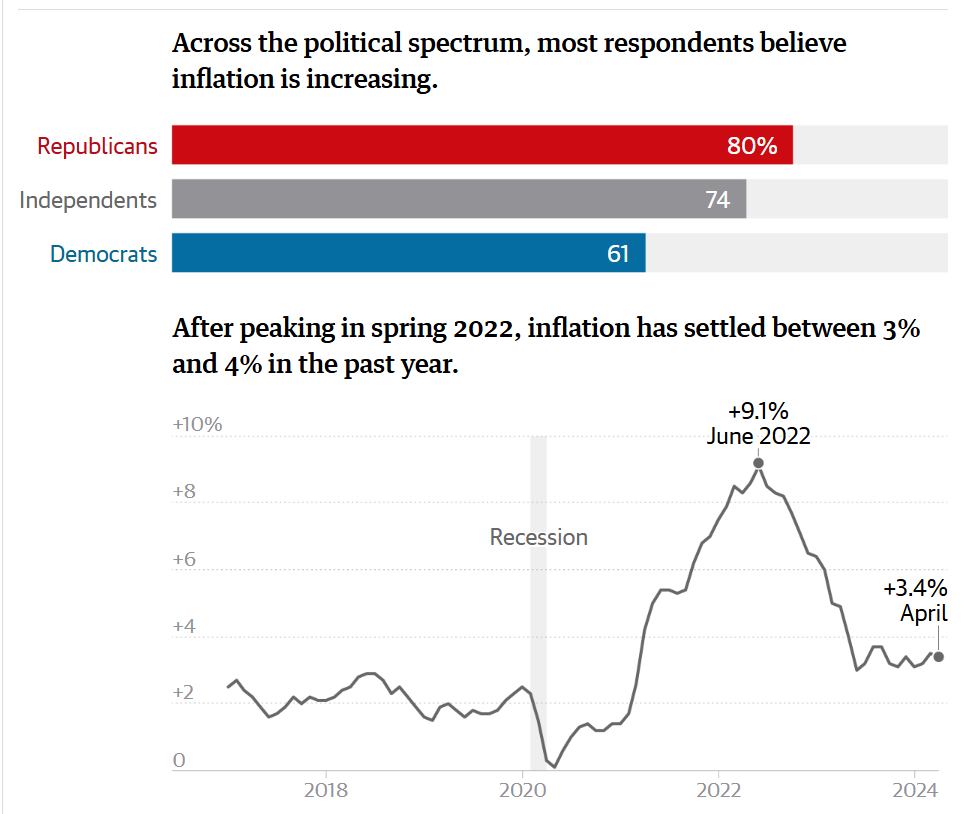

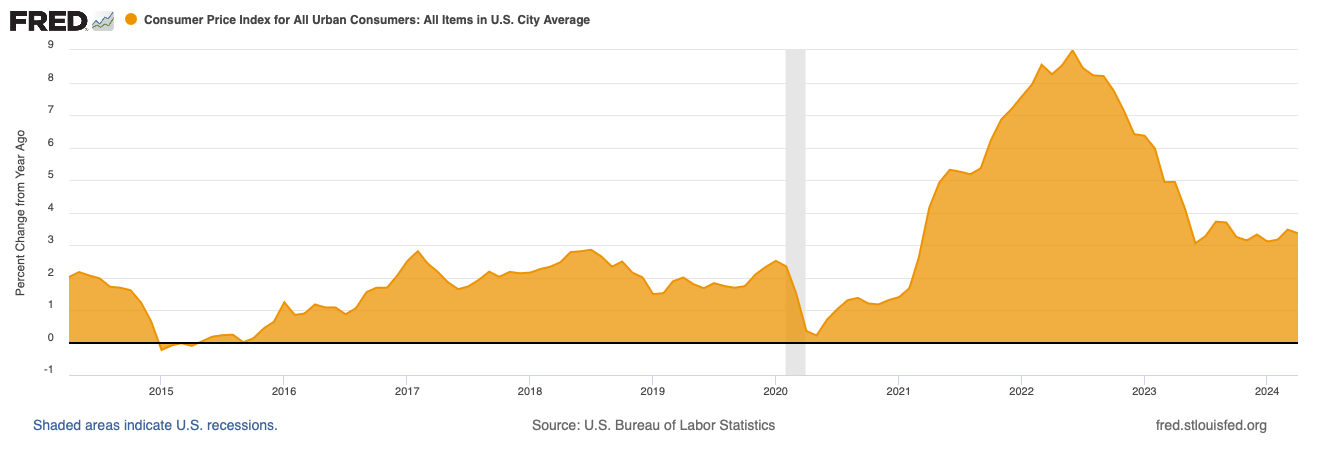

Inflation Confusion

A significant 72% of Americans feel that inflation is rising. While inflation has been a concern, it has significantly decreased from its peak of 9.1% post-COVID and now fluctuates between 3% and 4% annually. April saw inflation dip to 3.4%, down from 3.5% in March.

Inflation is decreasing, but that doesn’t mean prices will return to pre-pandemic levels. We will need deflation (prices to fall), and no one wants that to happen. It would damage the U.S. economy.

Political Blame Game

The poll reveals that 58% of Americans blame economic mismanagement on the Biden administration, with 70% of Republicans and 39% of Democrats believing the administration is worsening the economy. This sentiment persists despite the administration highlighting positive economic developments under "Bidenomics."

Understanding "Vibecession"

Economist kyla scanlon’s term "vibecession" aptly describes the gap between positive economic data and public pessimism. Despite indicators showing economic strength, 55% of respondents believe the economy is worsening, reflecting a disconnect between data and public sentiment.

Bipartisan Skepticism

Interestingly, skepticism about economic news is prevalent across party lines. More than 60% of Republicans and Democrats express doubts about the reliability of financial information they receive, highlighting a need for more transparent communication and education on economic matters.

Wealth Inequality

Jadrian Wooten, from Monday Morning Economist , highlights growing wealth inequality as a possible reason why the views of the economy are so pessimistic. Research shows that we care less about our overall wealth and more about our relative wealth. Therefore, subjective well-being rather than objective well-being drives this divide. Americans are better off than ever, but they feel worse off because of the comparison game we are all playing.

Social media has made this problem worse in three ways

It is easier to compare ourselves to others and how we spend our money and time.

Our comparison is based on what we see, and social media blurs the lines between reality and “creative expression.”

Dooms Day's social media narrative gets more clicks and goes viral, allowing misconceptions to spread.

Stay Updated

Stay tuned for more insightful discussions and updates on the economy. Don't forget to subscribe and share your thoughts. Stay informed and keep growing our community of curious minds!

Share

Help factual economics reach more people. Share this post with friends and save the U.S. economy!

What Other Economists Say

Claudia Sahm - Anger about the economy is everywhere (link)

Monday Morning Economist - The disconnect in our economic reality (link)

Some research shows that the cost of borrowing hurts people's perception of the economy. A lot of people buy things using credit, and interest rates have soared. That's not reflected in the inflation rate, but it certainly affects the cost of living.

Thanks for debunking these misconceptions.