As a professor of economics, I firmly believe that a solid grasp of economic principles can significantly improve one's decision-making and overall well-being. In today's newsletter, we'll examine a pressing issue affecting many of us: the US housing “crisis” and the role of big investors in the market.

The Big Players: Wall Street Firms

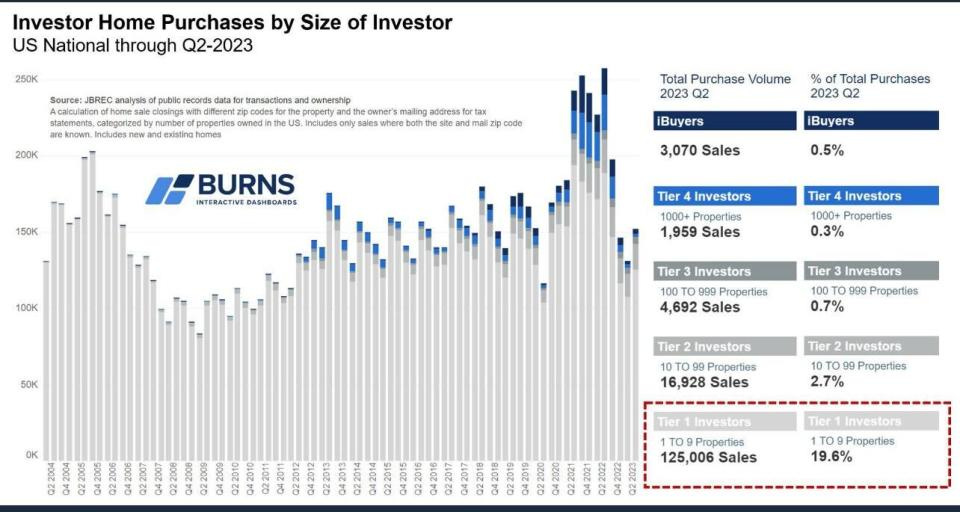

While you're busy navigating your daily life, a significant shift is happening in the housing market. Large investment firms, such as Invitation Homes and Blackstone-affiliated entities, have purchased vast quantities of single-family homes. These homes typically appeal to middle-class families—the charming three-bedroom in a desirable school district or the perfect starter home for first-time buyers. With their substantial financial resources and ability to make all-cash offers, these companies are outcompeting regular Americans, creating a scarcity of available homes and driving prices up.

Why Should You Care?

Whether you're looking to buy your first home or searching for an affordable rental, the actions of these institutional investors likely impact the prices and availability of homes in your area. As these firms convert homes from potential purchases into rental properties, they gain significant control over both the home buying and rental markets, potentially pricing out average families.

Government Intervention: Proposed Solutions

Lawmakers across the political spectrum are taking notice and proposing various measures to curb the ability of these institutional investors to dominate the housing market. These proposals include taxes to discourage bulk purchases of residential properties and mandates requiring the sale of homes to individuals rather than allowing them to remain part of extensive rental portfolios.

The Biden administration’s proposal to provide Americans with a $400 tax credit towards their mortgage will increase home prices and not help first-time home buyers. A basic understanding of Econ 101 tells us that this policy will only increase demand and lead to higher home prices. We need to increase supply so that more homes are available, which will, therefore, lead to lower home prices.

The Broader Context

Understanding the current housing market dynamics is crucial for potential homebuyers and all informed citizens. Today's decisions regarding the regulation and influence of large buying entities will shape the housing market for years.

Your Voice Matters

In a democratic society, staying informed is essential. As these issues unfold, your awareness and engagement can influence policies and decisions that impact housing affordability and availability. Whether through voting, community involvement, or simply initiating conversations about these topics, you have the power to make a difference.

Managing Your Finances in Uncertain Times

Maintaining financial fitness is more critical than ever in the face of these challenges. Budgeting, saving, and understanding economic forces will empower you to make informed decisions about buying a home or finding an affordable rental.

Stay tuned and stay informed as we continue to explore and explain the forces shaping our lives. By understanding these issues, you can better navigate them and contribute to the broader conversation about the future of housing in America.

Abdullah Al Bahrani is a professor of economics and associate dean at the Haile College of Business. His research focuses on household finance and financial and economic education. Subscribe to learn more and to join our community.

I don't think there is any evidence that large firms are causing anything in the market. They're simply not a big enough player. Your own chart shows that the Blackstone type firms all combined only purchased 0.3% of homes.