What Does The Latest GDP Data Tell Us About Demand Shifts and Inventory Buildup

Beyond the headlines

This week, we're examining the latest GDP report that reveals a concerning shift in economic momentum. The data deserves careful attention as it signals important changes in the economic landscape.

The Headline Numbers

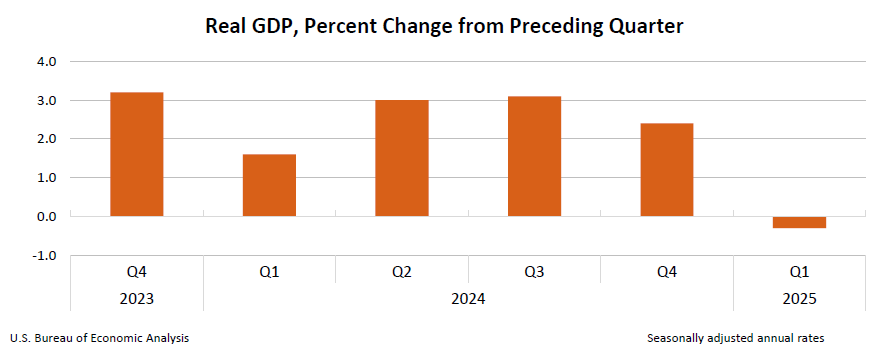

According to the advance estimate released by the U.S. Bureau of Economic Analysis, real gross domestic product (GDP) decreased at an annual rate of 0.3 percent in the first quarter of 2025. This represents a significant reversal from the fourth quarter of 2024, when real GDP increased 2.4 percent.

Beneath the Data

Real GDP in the first quarter compared to the fourth quarter reflected increased imports and a deceleration in consumer and government spending.

An increase in investment partially offsets these negative factors, primarily in the form of increased inventories. This inventory buildup warrants careful analysis: firms have imported goods anticipating impending tariffs and stockpiled them to avoid higher costs. This is not typical inventory accumulation that signals healthy anticipated demand, but rather defensive positioning against expected cost increases.

Notably, real final sales to private domestic purchasers — the sum of consumer spending and gross private fixed investment that many economists consider a better gauge of underlying demand — increased 3.0 percent in the first quarter, slightly higher than the 2.9 percent increase in the fourth quarter. This suggests that private sector activity remains relatively robust despite the headline GDP contraction.

However, the critical question is whether this demand represents:

Pull-forward demand - consumers and businesses accelerating purchases before anticipated price increases from tariffs

Sustained demand - genuine growth in consumption and investment that can carry forward

The distinction is crucial: pull-forward demand creates a temporary boost followed by a potential vacuum, while sustained demand provides ongoing economic momentum. The inventory buildup suggests firms are betting on scenario #1, as they rush to import and stockpile goods before tariff implementation. Should consumer demand falter after this initial surge, these bloated inventories could trigger production cutbacks in coming quarters.

Moreover, increased spending on imports in anticipation of tariffs may have forced businesses to forgo other investments or spending. This change in behavior in response to policy is an example of the inefficiencies of taxes.

Inflation Signals Intensifying

The latest GDP report also contains concerning inflation data:

The price index for gross domestic purchases increased 3.4 percent in the first quarter, compared with 2.2 percent in the fourth quarter

The personal consumption expenditures (PCE) price index increased 3.6 percent, up from 2.4 percent

Excluding food and energy prices, the core PCE price index increased 3.5 percent, compared with 2.6 percent previously

This acceleration in price pressures across multiple measures suggests that inflation remains a significant economic challenge and is likely exacerbated by anticipatory price increases ahead of tariff implementation.

The Takeaway

The first quarter GDP contraction represents the first negative reading since the pandemic era and demands careful interpretation. While the headline number suggests economic weakness, the details reveal a more nuanced picture of an economy reacting to anticipated policy changes rather than fundamental weakness.

More concerning is the acceleration in price pressures across multiple inflation measures. With both the headline and core PCE price indices showing significant increases, the Federal Reserve faces increasingly difficult policy choices. Contracting GDP and rising inflation—reminiscent of stagflation scenarios we've discussed in previous newsletters—create a challenging environment for policymakers.

For economists and market participants, distinguishing between pull-forward demand and sustainable growth will be critical in the months ahead. As pre-tariff inventories are worked through and the full impact of trade policy changes manifests, we'll gain better insight into the economy's underlying trajectory. Until then, expect continued volatility in economic data and markets as participants adjust to this shifting landscape.

Stay informed,

Dr. A

"Economics with Dr. A" is a newsletter dedicated to bringing economic insights to young professionals and students. Subscribe to our mailing list for in-depth analysis, historical context, and practical guidance for navigating our complex economic landscape.

Share the Knowledge: If you found this analysis valuable, please forward it to colleagues and classmates who would benefit from understanding these economic trends. Economic literacy is our best defense against uncertainty.

This os very insightful. I keep hearing the pro tariff crowd say look prices hasn't gone up and you explain why. Much of the public is misinformed on how business operations work and safety stock is a common methodology of preparing for a shock.