Debt and Delinquencies Are On the Rise

Create a Strategy to Stay Ahead

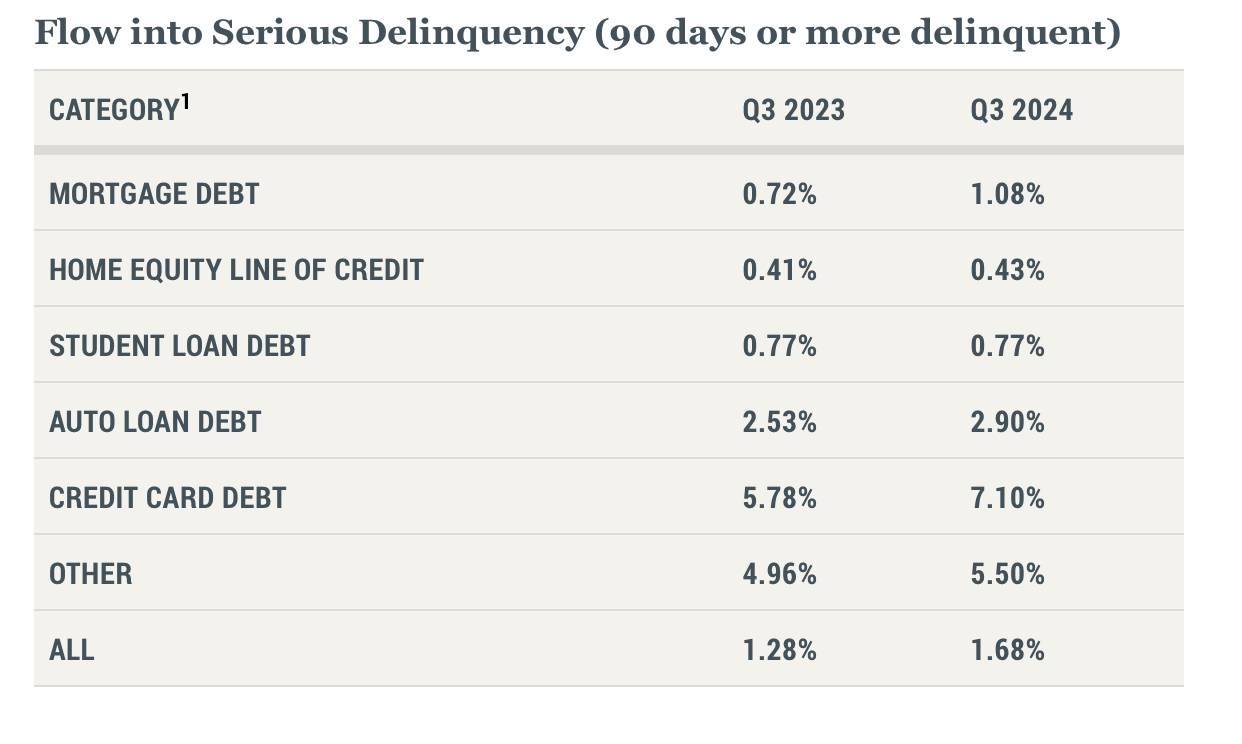

Do you think your credit card balance is creeping up? You're not alone. A whopping 7.1% of credit card debt is now delinquent. I recently shared a post about how consumers have propped the economy post-COVID-19 pandemic. Well, that momentum might be fizzling.

According to the New York Federal Reserve Bank

Credit card delinquencies jumped from 5.78% to 7.10% in just one year

Mortgage delinquencies increased from 0.72% to 1.08%

Total household debt hit a new record, with credit cards and mortgages leading the surge

Why is This Happening

The Post-Pandemic Spending Reality: The "revenge spending" we all jumped into after lockdowns? Many of us put travel, experiences, and delayed purchases on credit, assuming we'd figure it out later. Well, "later" is now.

Increasing Interest Rates: Remember those zero-interest credit card offers? Many have expired, and new rates are brutal. A $3,000 credit card balance at 24% APR costs you $720 per year just in interest.

The Housing Market Impact Even if you're not a homeowner, this affects you. Rising mortgage delinquencies could lead to stricter lending standards, making qualifying for your first home purchase harder.

What This Means for You

For Students:

Your credit score now will impact your post-graduation housing options

Student loan payments + credit card debt = dangerous combo

Building credit responsibly is more crucial than ever

For Early Career Professionals:

Your debt-to-income ratio affects everything from apartment applications to job opportunities

High credit card balances can limit your ability to save for major life goals

Make sure your emergency fund is fully funded.

Money Tips

The 48-Hour Rule: Wait 48 hours before making any non-essential purchase over $100. This will prevent impulse spending without totally restricting your lifestyle.

The Debt Snowball Strategy: List your debts from smallest to largest, paying the minimum on all except the smallest, and attacking that one aggressively.

The 1/3 Credit Rule: Keep your credit utilization under 30%. If your limit is $3,000, stay under $1,000, even if you pay in full monthly.

The Takeaway

Consumer spending has kept this economy going, but now is a good time to consider your personal finances. Audit your debt, create a payoff strategy, and build an emergency fund before higher rates and stricter lending make it harder to recover.

Interestingly, a quarterly +21 increase in student debt but a +7 annual increase, which indicates an overall decrease during the previous three quarters. Sources?