Vibecession: Exploring the Growing Divide Between Economic Facts and Feelings!

You are better off than you think

There is a large and growing divide between the positive economic data we see and what people think about their economic well-being. Never before have American consumers’ finances been better than they are today. Yet, when polled recently, most Americans say they are worse off financially and aren’t doing well. Today, we will dig into the numbers and see what might explain this growing divide between perception and reality.

When polled, most Americans say they are worse off since Biden took office. However, the economic data says differently.

has a great write-up on the data. I highly recommend you read her post for additional perspective.Today, I want to share some of my views on this topic because as we end 2023, it is great practice for us to summarize where we stand today and anchor our discussion on the data.

The Stock Market isn’t the Economy

on Marketplace Radio is famous for saying that the stock market is not the economy. However, most people look at the stock market for signs on how the “market” is doing and how it “feels” about the economy. If you had invested $1,000 in the S&P 500 index on January 1, you would have $1,201.48 today (December 3rd, 2023). That is an increase of 20.1% over the year. During that period, CPI grew from 300.5 to 307.6 (October) which is an increase of 2.36%. In real terms, the market has returned 17.7% in the same period. Investment wealth is increasing in the U.S. However, we know that only 61% of Americans invest in the stock market, and that varies drastically by income, education, age, and martial status. The gains in wealth from the strong stock market have not been felt equally across America.

Economic Growth is Strong

Annualized Real GDP growth in Quarter 3 of 2023 clocked in at 5.2%. By all means this is a high growth rate and a good sign for the economy. However, overall GDP growth hides a lot of information, while it tells us how the overall economy is doing it misses some important aspects like inequality and how growth is divided across Americans. I suspect that is where all the negative talk about the economy comes from.

Why Are You So Negative?

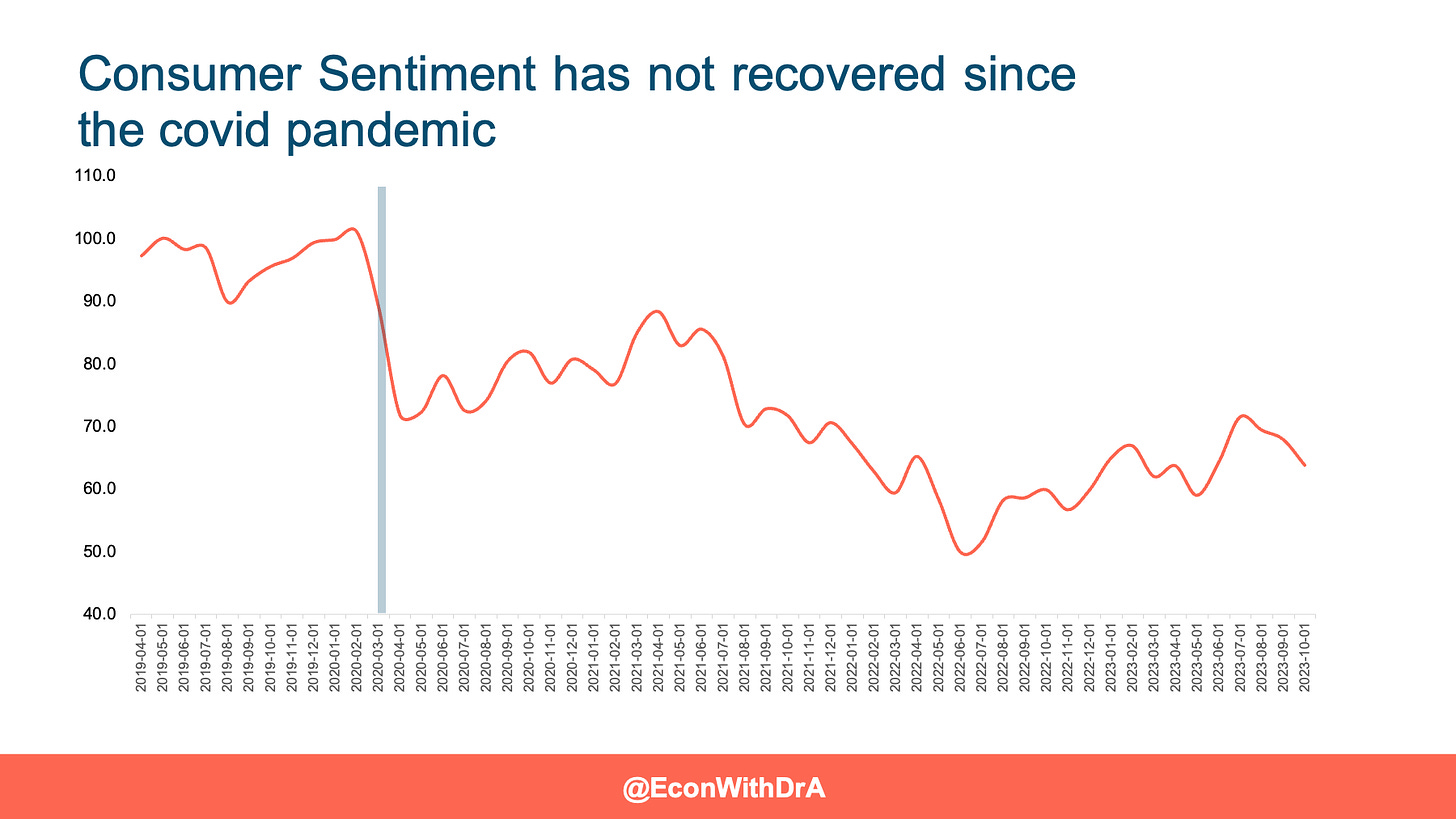

The University of Michigan’s consumer sentiment index provides us with a measure of how consumers feel about the economy. The index shows that consumers have been feeling blue about the economy since the Covid shutdowns and the index has not recovered. In fact, it continues to drop over time.

Silent Depression

The divide between real economic data and consumer sentiment is widening. Negative talk about the economy has lead to social media trends referring to this economy as the silent depression. I have previously discussed this and have a video on the topic. Silent depression trend was the first sign of a diverging economic view, mostly driven by inaccuracy around how to analyze economic data.

So Why are People Unhappy?

I suspect there are several reasons. First and most importantly, while overall wealth has increased, this does not say much about consumers’ pocketbooks. Average prices in the economy have been growing at a faster rate than average wage growth. Since 2021, inflation rates have been higher than the rate of wage growth. Luckily, that trend has recently changed as of May 2023. The consumer, however, has lost a lot of purchasing power and making up that difference will take higher wage growth rates.

Additionally, the increase in interest rates has made consumer debt more costly. While the average consumer was worried about inflation, the increasing interest to combat inflation have started to hurt spending. The increase in housing prices coupled with mortgage rates going up has caused homeownership to seem like an unattainable American dream, especially, for younger Americans looking to start their wealth building journey. This probably speaks more to the rise in the social media trend around the “Silent Depression” narrative.

The Psychology of Comparison

The Income Report by the Census Bureau shows that income inequality is growing. The income Gini index decreased by 1.2 percent between 2021 and 2022; this represents the first time the Gini index has shown an annual decrease since 2007. We have also seen poverty rates increase as government Covid relief programs have come to an end.

We know, from the Relative Income Hypothesis, that people care more about their relative income rather than their standard of living. All of this leads us to the psychology of economics and how it impacts our views. I believe, what is fueling this negative sentiment is more psychology rather than facts.

Here are some psychological areas that are influencing overall sentiment:

Social Comparisons: The relative income hypothesis suggests that individuals tend to make social comparisons and assess their well-being in relation to others. If people perceive that their income is falling compared to others in their reference group, it could lead to a more negative outlook of the economy.

Income Inequality: Consumer sentiment can be influenced by the level of income inequality in society. High levels of income inequality might lead to dissatisfaction among those with lower incomes, potentially impacting their consumer sentiment.

Perceived Economic Conditions: Relative income also plays a role in how individuals perceive the overall economic conditions. Even if the economy is growing, if people feel that the benefits are not distributed fairly or that others are doing better, it can affect consumer sentiment.

Do Not Ignore the Politics

While the economic data indicates a strong economy, the divide reflects political views of America. There is a strong correlation between party of affiliation and views on the economy. In swing states, 89% of republicans said that the state of the economy is worse off compared to 59% of democrats. We also know that people rate the economy more poorly when their party is not in power. As America becomes more polarized, our views of the economy will be shaded by consumers’ political affiliations.

The Takeaway

The divergence between economic data and perception is growing. Most economic data shows a stronger economy, more wealth accumulation, and real increases in wage growth. Perception is not reality, but someone needs to convince the U.S consumer of this truth.

We are also seeing a divergence in what consumers say versus what they do. Consumers’ spending and saving behaviors indicate that they are still doing well. They continue to spend, deplete their savings, and make additional purchases, all of which are usually a sign that the consumer believes tomorrow is going to be better than today! The real divide is between what Americans say they feel about the economy and how they are actually behaving in their personal lives.

If you enjoyed this post, please share it with friends and colleagues. We are excited to grow our community in 2024 and your help will be greatly appreciated.