Market Retreat

The stock market has erased all gains made since November, signaling investor concerns about economic stability. This reversal comes after months of optimism and represents a significant shift in market sentiment. Major indices, including the S&P 500, Dow Jones Industrial Average, and NASDAQ, have seen substantial pullbacks.

Growth Projections Turn Negative

Concerning development, the Federal Reserve Bank of Atlanta has released its latest GDP expectations, projecting a decline of 2.8%. This forecast represents a dramatic shift from earlier projections and suggests the economy may contract more rapidly than anticipated. If realized, this would mark the first significant economic contraction since the pandemic-induced recession.

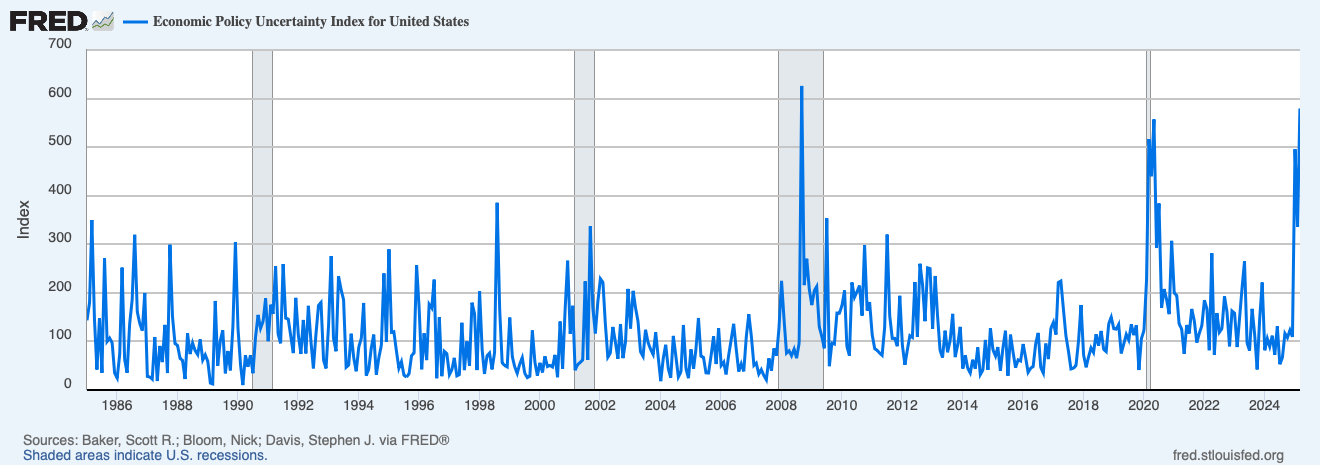

Uncertainty at Historic Levels

The Global Economic Uncertainty Index has reached levels not seen since the 2008 financial crisis. This metric measures policy uncertainty across major economies and indicates widespread concern about economic stability and future growth prospects. Such elevated uncertainty levels have historically preceded significant market adjustments and economic challenges.

Contributing Factors

Several factors appear to be driving these concerning trends:

Persistent inflation pressures despite earlier monetary tightening

Geopolitical tensions creating additional market volatility

Tariffs and uncertainty about U.S. fiscal policy

The Takeaway

Market uncertainty will cause some people to hold back on spending. Investors like Warren Buffet have already signaled that they are holding more cash, a sign that they expect the markets to decline. These signs of weakness might be centered on financial markets. On March 7th, new unemployment data will be released, providing insight into what is happening in the labor market.